Exciting news: for those who prefer to give online, we want to let you know that we have moved to a new giving platform called Subsplash. This makes online giving easier than ever and saves the church money, so more of your gift goes to ministry instead of transaction fees.

If you have a recurring gift already established with myRBC (Church Community Builder, or CCB), action is required! Please activate your Subsplash Giving account, set up your new recurring gift there, and then cancel your existing gift through myRBC. Please complete the steps below either on a web browser or via the RBC app on your phone or tablet:

STEP 1: ACTIVATE YOUR SUBSPLASH ACCOUNT. For most, your Subsplash giving profile is already linked with CCB, so all you’ll need to do is activate your Subsplash account. CLICK HERE to begin the process.

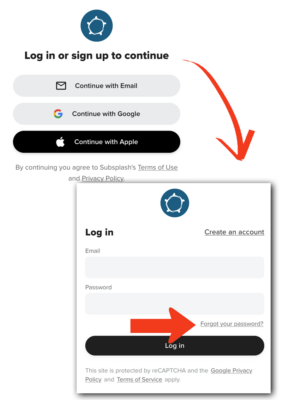

On the “Login or Sign up to Continue” page at the link above, select your preferred method of authentication (i.e., how you sign in.) Your account is tied to your email address, which allows you to choose one of several authentication methods, including email, Apple (if you are on iOS, iPadOS, or Safari) or Google.

On the “Login or Sign up to Continue” page at the link above, select your preferred method of authentication (i.e., how you sign in.) Your account is tied to your email address, which allows you to choose one of several authentication methods, including email, Apple (if you are on iOS, iPadOS, or Safari) or Google.

-

- Email is preferred – continuing with email will take you through the traditional email/password setup. If you choose this option, click the Forgot your password? link.

- Enter your email address on the next screen and click the “Send reset email” button.

- Check your email for the “Reset password” link from Subsplash and follow the instructions to set your account password. *If you did not get the password reset email, no longer have access to that email account, or prefer to use a different email to activate your Subsplash account, instead of clicking or tapping the “Forgot your password?” link, use the “Create an account” link and follow the instructions from there.

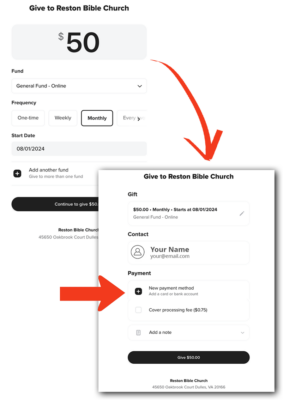

STEP 2: SET UP YOUR NEW RECURRING GIFT IN SUBSPLASH. Subsplash Giving offers four recurring gift frequencies for you to choose from! CLICK HERE to go to the Subsplash giving page, then follow these steps to create your recurring gift:

1. Enter the amount of your recurring gift.

1. Enter the amount of your recurring gift.

2. Select the fund you would like your gift allotted to (FYI, the General Fund gives us the most flexibility in stewarding your gift, however you may split your gift allocation between multiple ministry funds. To do so, click “Add another fund.”)

3. Change the Frequency to weekly, monthly, every two weeks, or twice a month and select the start date for your first gift.

4. Click the “Continue to give $_____” button. If you are not logged in, select your preferred method and enter your account password. On the next page, you will see a summary of your gift, and can edit the start date if you desire.

5. Add a payment method by clicking the “New payment method” link. Then follow the instructions to add a card, Apple Pay or US bank account.

6. Click the “Give $_____” button at the bottom of the screen. Your recurring gift is set up! You’ll see a confirmation screen and receive a confirmation email.

STEP 3: CANCEL YOUR OLD RECURRING GIFT IN myRBC/CCB. Now that your recurring gift is set up in Subsplash, please cancel the old recurring gift – CLICK HERE and follow the instructions below:

- Log in to your myRBC (CCB) account. If you have any issues logging in, contact Hanibeth Yearick.

- Click “My Giving” in the left-hand column. Your recurring gift should be listed under the “Repeating Gift Schedules” at the top of the page.

- Click the “Cancel” link at the far right of your recurring gift line, then click “Confirm” in the pop-up window.

Any questions or issues? Please see our FAQ section below or contact Jennifer Reynolds, our church accountant.

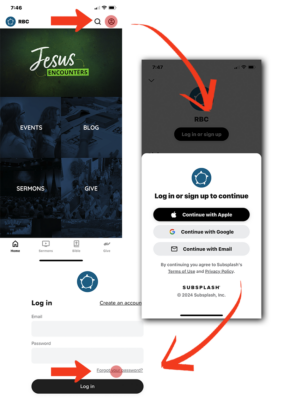

We are pleased to introduce a new version of the RBC app which directly incorporates Subsplash giving! To set up your recurring gift through the app, download the app from the Apple iTunes App Store, Google Play or Amazon Appstore, then follow the instructions below.

STEP 1: ACTIVATE YOUR SUBSPLASH ACCOUNT. For most, your Subsplash giving profile is already linked with CCB, so all you’ll need to do is activate your Subsplash account.

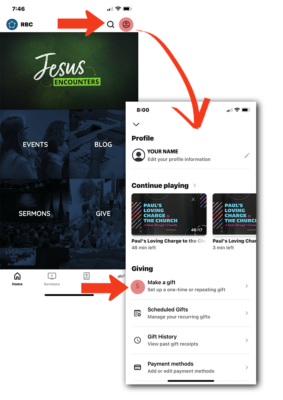

1. Open the RBC app and tap the user icon at the top right of your screen, then tap the “Log in or sign up” button.

1. Open the RBC app and tap the user icon at the top right of your screen, then tap the “Log in or sign up” button.

2. On the “Login or Sign up to Continue” page at the link above, select your preferred method of authentication (i.e., how you sign in.) Your account is tied to your email address, which allows you to choose one of several authentication methods, including email, Apple (if you are on iOS, iPadOS, or Safari) or Google.

-

- Email is preferred – continuing with email will take you through the traditional email/password setup. If you choose this option, tap the Forgot your password? link.

- Enter your email address on the next screen and click the “Send reset email” button.

- Check your email for the “Reset password” link from Subsplash and follow the instructions to set your account password. *If you did not get the password reset email, no longer have access to that email account, or prefer to use a different email to activate your Subsplash account, instead of clicking or tapping the “Forgot your password?” link, use the “Create an account” link and follow the instructions from there.

STEP 2: SET UP YOUR NEW RECURRING GIFT IN SUBSPLASH. Subsplash Giving offers four recurring gift frequencies for you to choose from! With the RBC app open, follow these steps:

1. If you are not automatically signed in, tap the user icon at the top right of your screen, then tap the “Log in or sign up” button, then enter your password in your preferred login method.

1. If you are not automatically signed in, tap the user icon at the top right of your screen, then tap the “Log in or sign up” button, then enter your password in your preferred login method.

2. On your Profile page, tap “Scheduled Gifts” then tap “Make a gift” to set up your new recurring gift.

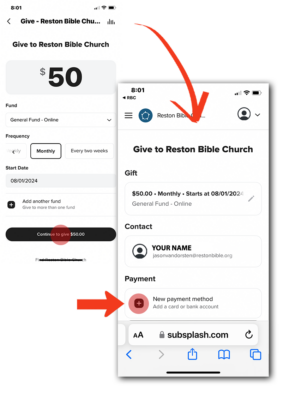

3. Enter the amount of your recurring gift.

4. Select the fund you would like your gift allotted to (FYI, the General Fund gives us the most flexibility in stewarding your gift, however you may split your gift allocation between multiple ministry funds. To do so, tap “Add another fund.”)

5. Change the Frequency to weekly, monthly, every two weeks, or twice a month. You can also set the start date to begin your recurring gift.

5. Change the Frequency to weekly, monthly, every two weeks, or twice a month. You can also set the start date to begin your recurring gift.

6. Tap the “Continue to give $_____” button.

7. Add a payment method by clicking the “New payment method” link. Then follow the instructions to add a card, Apple Pay or US bank account.

8. Click the “Give $_____” button at the bottom of the screen. Your recurring gift is set up! You’ll see a confirmation screen and receive a confirmation email.

STEP 3: CANCEL YOUR OLD RECURRING GIFT IN myRBC/CCB. Now that your recurring gift is set up in Subsplash, please cancel the old recurring gift – go to restonbible.ccbchurch.com and follow the instructions below:

- Log in to your myRBC (CCB) account. If you have any issues logging in, contact Hanibeth Yearick.

- Select “My Giving” in the upper left-hand menu.

- Select the Schedules/History tab. Your recurring gift should be listed under the “Repeating Gift Schedules” section.

- Tap the “Cancel” link at the far right of your recurring gift line, then tap “Confirm.”

Any questions or issues? Please see our FAQ section below or contact Jennifer Reynolds, our church accountant.

We are grateful for your continued generosity, support and partnership in ministry as we seek to know Jesus and make Him known. Please see the FAQ section below. If you have any additional questions about this change or would like help transferring your recurring online gift, please contact Jennifer Reynolds, church accountant, at jenniferreynolds@restonbible.org or 703-404-5010.

SUBSPLASH GIVING - FAQs

There are several reasons for this change:

- Online giving for both recurring gifts and one-time gifts are easier and faster.

- Giving options are expanded and are more flexible, including the ability to easily edit recurring gifts or to split gifts between various ministry funds.

- RBC benefits from reduced annual expenses due to lower processing fees and the new option for RBCers to cover the processing costs of their gifts.

- Subsplash giving integrates seamlessly with the new RBC app. Giving can be done quicker and easier through directly from your phone or device through Android, Apple, and Amazon versions of the app.

You do not need the app to give online! Online giving can still be done through the website as usual, if that is your preference.

If you prefer to not give online at all – no problem! Gifts may still be given by cash or check in the offering boxes located at the back of the sanctuary or near the Welcome Desk in the lobby. (If you prefer to mail your gift, our address is 45650 Oakbrook Ct., Dulles, VA 20166.)

However you choose to give, know that we are so grateful for the Lord’s provision expressed through your generosity.

Even if you don’t want to use the app for giving, there are still lots of benefits to downloading the app to your tablet or phone. The RBC app now has an improved user interface and is more robust – you can access sermons, blog posts and events; access multiple versions of the Bible with reading plans and audio features; download RBC sermons for offline listening; take and save sermon notes, and more.

Yes! In addition to the RBC website SSL (Secure Sockets Layer – for data integrity, privacy and authentication), Subsplash uses industry standard PCI DSS, or Payment Card Industry Data Security Standards. PCI DSS is a set of strict security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a highly secure environment.

Subsplash’s Level 1 PCI compliance certification is audited annually by a PCI Qualified Security Assessor and Subsplash’s secure gateway is PCI Level 1, SOC1, and SSAE 16 compliant.

For additional information or to request an attestation of compliance document from Subsplash, click here .

If you followed the instructions above to activate your account via email, but did not receive an email link to reset your password, please make sure that you are using the same primary email associated with your myRBC account.

If you followed the instructions above to activate your account via email, but did not receive an email link to reset your password, please make sure that you are using the same primary email associated with your myRBC account.

If you did not get the password reset email, no longer have access to that email account, or prefer to use a different email to activate your Subsplash account, instead of clicking or tapping the “Forgot your password?” link, use the “Create an account” link and follow the instructions from there.

Still having an issue setting up or accessing your account? Please contact Jennifer Reynolds, church accountant, at jenniferreynolds@restonbible.org or 703-404-5010.

Yes! To continue to give one-time gifts online, please follow the same instructions above to set up a Subsplash Giving account, but select “One-time” in the Frequency section. Setting up a Subsplash account ensures your gifts will still sync with your myRBC giving history.

While we are phasing out the use of myRBC for giving, it will still be used for event registrations and event payments. Additionally, your giving information from Subsplash will securely sync to myRBC, so you will still access your giving history and be able to download your giving statements from myRBC.

If you have questions about myRBC or need help with your myRBC account, click here.

Once you’ve activated your Subsplash account and have logged in, tap the profile/user icon in the top right corner of the RBC app or click the user icon at the top right corner of the web interface. From there, you’ll see a link to view your gift history under the “Giving” section.

Once your new recurring gift is set up in Subsplash, it will be reflected in your giving history after it is processed on the start date you specified. Your previous myRBC giving history will also be visible in Subsplash in the months ahead after we fully phase out myRBC giving.

Your giving information from Subsplash will securely sync to myRBC, so you can still access your giving history and download your giving statement from myRBC.

If you have questions about myRBC or need help with your myRBC account, click here.

RBC pays a fee for each electronic gift transaction that takes place online. The fees for ACH (direct transfer from a US bank account) are generally much lower than the fees to process a credit card payment—so giving directly from a bank account does provide additional benefit to the church.

Whether you give by ACH or credit card, Subsplash Giving now allows givers the option of covering that small processing fee, which could also add up to significant reduction in the fees RBC pays for online giving transactions. If you would like to cover the transaction fee for your giving, you will see a checkbox option to do so when setting up your recurring gift or when giving a one-time gift.

However you choose to give, know that we are deeply thankful for the kind provision of the Lord expressed through your giving!

Once you’ve activated your Subsplash account and have logged in, you can easily edit your account information by tapping the profile/user icon in the top right corner of the RBC app or by clicking the user icon at the top right corner of the web interface. From there, you’ll be able to edit your profile (name, contact info, etc.), reset your password, view your gift history, manage your payment methods and gifts, or delete your account.

If you get an error message associated with changing your account info, please contact Jennifer Reynolds, church accountant, at jenniferreynolds@restonbible.org or 703-404-5010.

We would be very happy to walk you through the process! Please contact Jennifer Reynolds, church accountant, at jenniferreynolds@restonbible.org or 703-404-5010.

Reston Bible Church exists “to know Christ and make Him known” in Northern Virginia and around the world. Your faithful giving plays an integral part in fulfilling that mission.

Click here to see why we celebrate what God is doing with your generosity.

GIVE ONLINE

GIVE BY CASH OR CHECK

If you prefer to mail your gift, our address is 45650 Oakbrook Ct., Dulles, VA 20166.

GIFTS THAT HELP TODAY

These tax deductible donations have an immediate impact on the ministries supported by the church.

Stocks and mutual funds held long term (a year and a day or more) may be given to the church with the giver generally qualifying for a contribution deduction based on the market value of the stock as of the date of the gift. If the same stock is sold and the proceeds donated, the appreciated gain would be taxable as a capital gain. If you would like to donate securities, please contact your broker and request that the stock be transferred to E*Trade (DTC: 0015, Account #: 511 823352). Please also contact Jennifer Reynolds to let her know of your donation and which fund the donation should go to.

Individuals who are age 70-1/2 or older can distribute funds, known as a Qualified Charitable Distributions, out of an IRA to RBC tax free. Those 72 and older have the added benefit of counting their donation towards their RMD. The donation must be paid directly from your IRA to RBC. Contact your IRA trustee for specific details on how to make the donation.

Individuals who are age 70-1/2 or older can distribute funds, known as a Qualified Charitable Distributions, out of an IRA to RBC tax free. Those 72 and older have the added benefit of counting their donation towards their RMD. The donation must be paid directly from your IRA to RBC. Contact your IRA trustee for specific details on how to make the donation.

Does your employer have a matching gift program? Did you know that many area employers, including government offices, will match your gift to RBC? To find out if your employer has a matching gift policy, just click here.

Givers considering selling can potentially reduce taxes by giving appreciated commercial, residential or undeveloped property.

This is an irrevocable trust designed to provide financial support to the church for a period of time, with the remaining assets eventually going to family members or other beneficiaries.

If you have a used car that’s in good condition that you’ve been thinking of trading in or selling, why not donate it to RBC instead? In many cases, you are able to claim the fair market value as a charitable gift. Our deacons are aware of several families that would be blessed by a reliable car. Please email deacons@restonbible.org for more information.

You are now able to contribute cryptocurrency to Reston Bible Church.

Give cryptocurrency via EngivenYour donation is tax deductible to the extent allowed by law. Every effort will be made to honor your donation preference, however, please understand that Reston Bible Church retains complete discretion and control over the use of donated funds as required by the IRS.

GIFTS THAT HELP LATER

A life insurance policy is one way to leave a legacy gift – not just for the people you love but for the church and ministries that are important to you. Your gift will go directly to RBC even if live long on the earth. Permanent life insurance policies stay in force throughout the giver’s life as long as they continue to pay premiums.

A Retained Life Interest is a gift to the church of a personal residence or farm. The giver retains ownership and the right to live in the property for the rest of their life. Upon death, the church is deeded the property allowing the church to sell the property and use the proceeds for ministry growth.

Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, a church, trust or foundation. Anyone can make a bequest – in any amount – to an individual or church.

GIFTS THAT PRODUCE INCOME

A Charitable Gift Annuity is a contract that provides you with a fixed income stream for life in exchange for a sizeable donation to a church. In addition to receiving an income, you may also see a 20-55% tax deduction.

A Charitable Remainder Trust (CRT) is an irrevocable trust that generates a potential income stream for you, or other beneficiaries, with the remainder of the donated assets going to the church.

GIVING STATEMENTS

Contribution statements for every year since 2010 are available in your myRBC profile. Your giving statement will not be mailed to you unless you specifically ask us to do so. To print your statement, simply follow these steps:

- Log into myRBC

- Click on the “$/Give” button on the left

- Click on “Schedules/History” at the top

- Click on “Giving Statement” (upper right corner)

- Make sure “Type” is set to “Family”

- Set the “Quick Date Range” to “Last Year” (or another year of your choice) and then click “Run Report”

GIVING HISTORY: Once your recurring gift is set up in Subsplash, it will be reflected in your giving history. Previous giving history (prior to Subsplash) will also be visible in Subsplash in the months ahead.

If you are not a member of the RBC online community, but would like to sign up, please request a login or click here for more information on myRBC.

If you have any questions about giving online, RBC budget/finances, your giving statement, non-cash gifts, or the myRBC Online Community, please contact Bruce Campbell (brucecampbell@restonbible.org) or Jennifer Reynolds (jenniferreynolds@restonbible.org).